Investing in Improvements in Malta

Since taking over the concessions, Steward Malta has made significant, long-term investments in staff training and development, emergency transport, and medical facilities to improve patient access to our services for the benefit of the people and the communities we serve across St Luke’s, Karin Grech, and Gozo General Hospitals.

Steward International’s First 100 Days in Malta

When Steward International took over the concession, we took on a business that was unable to cover salaries, had no established management accounts, and no annual statements prepared or filed. VGH, the previous owners, displayed an inability to raise the required project financing from banks and was relying on bridge financing from individuals.

There was no tangible evidence of improvements in medical service delivery and quality of care. Queen Mary University of London were on the verge of ending their relationship with Malta due to the staggeringly poor state of the Bart’s Medical School site on Gozo – which appeared to consist only of a hole in the ground. In the background, the negative PR and levels of public scrutiny were steadily mounting.

In the first 100 days of the new concession, Steward International empowered a capable leadership team and initiated a large scale lay-off of non-essential administrative personnel which recovered annual net savings of €1.8 million. We decreased overhead expenses by terminating all unnecessary real estate rentals and selling all seven luxury vehicles we inherited. In addition to paying the acquisition cost, Steward International made an immediate capital injection of $8 million USD for salary support, critical vendor bills, and critical capital needs such as patient transport vehicles to ensure that the hospitals could keep running. Steward International also repatriated all funds wherever possible.

Steward International restructured the finance team and established proper accounting procedures and accounts with the assistance of auditing firms. We built a relationship with Bank of Valletta, a significant regional lender, and enacted KYC procedures. As physician-led professionals, we managed to salvage the relationship with Queen Mary University of London, initially as a result of frequent meetings in London with academic and operational leaders to discuss the Bart’s Medical School. In Malta, we rebuilt relationships with the Tax Department and agreed an immediate payment plan to cover the National Insurance; this is now completely paid off.

At a corporate governance level, Steward International immediately simplified the organisation into an onshore, EU-based structure. VGH had obscured their ultimate beneficiaries in the concession through multiple layers of offshore companies in the British Virgin Islands. These holding companies were then moved to Jersey after scrutiny on British Virgin Islands companies increased. Under VGH, ownership shares were given to multiple entities to acquire capital and credibility. Additional companies were brought in to establish exclusive contractual binds with hospitals for supplies.

To rectify this, Steward International removed all holding layers and incorporated a simple corporate structure for Malta, primarily incorporated in Malta. We cancelled all questionable agreements, especially those providing exclusivity in procurement, and removed company layers. We sold all non-concession assets and repatriated most funds into the company (approximately €6.5 million).

The state of the management of the concession now reflects Steward International’s commitment to transparency, responsibility, and accountability. We have operated at all times to provide professional health services for the people of Malta and we are proud of having turned around a failing concession.

The state of the management of the concession now reflects Steward International’s commitment to transparency, responsibility, and accountability. We have operated at all times to provide professional health services for the people of Malta and we are proud of having turned around a failing concession.

Major projects have included:

- 24/7 air ambulance service (2 helicopters based on island of Gozo) reducing transit time of critical air transfers from GGH to Mater Dei Hospital from an average of 3 hours to under 1 hour.

- New bespoke Orthotics and Prosthetics Unit with attractive and welcoming patient and clinical areas, new equipment, appropriate workshops and storage facilities, world renowned suppliers and innovative digital solutions to provide a seamless patient care pathway.

- New Hospital Fleet consisting of 14 coaches, 3 light vehicles, 1 rapid response vehicle, doubled the number of ambulances in Gozo from 3 to 6.

- New laboratory at GGH, introducing advanced technology and first-level automation including: cutting-edge, automated immunoassay analyser; integrated chemistry system; robotic interface solution that performs intelligent sample processing; fully automated, high-volume diagnostic haematology analyser; a digital morphology system; and a compact haemostasis analyser, the first of its kind on the Maltese islands.

- New Dedicated 10-bed Ward for Orthopaedic Cases to cater for a wider range of Orthopaedic Surgery in Gozo (including joint replacements).

- New 28-bed Inpatient rehabilitation Ward at KGH, increasing total bed numbers from 270 to 298.

- Upgrade and expansion of Physiotherapy Outpatients Department facilities and replacement of all equipment for service users and staff (no investment seen since before 2007).

- New Medical School built in 17 months, the Barts/QMUL campus is a state of the art 8,800 square metre four-storey building, supplemented by an Anatomy Centre on same campus.

- Installation of the VIE system (Liquid Oxygen by bulk) in Gozo increasing the island’s autonomy for oxygen from 3 – 4 days to 4 – 6 weeks.

- Reengineering of the Outpatients Department at GGH including all services required to provide an extension to the GGH Emergency Department with an additional 15 to 25 equipped couches in case of major disaster/large-scale incident.

- Replacement of Medical Gases Plant to ensure regulatory and HTM compliance.

- Expansion of GGH Emergency Department, from 6 cubicles + 1 resus to 8 cubicles + 2 resus.

- Investment of 5M+ in biomedical equipment for the introduction of new services or the provision of existing services with modern technology.

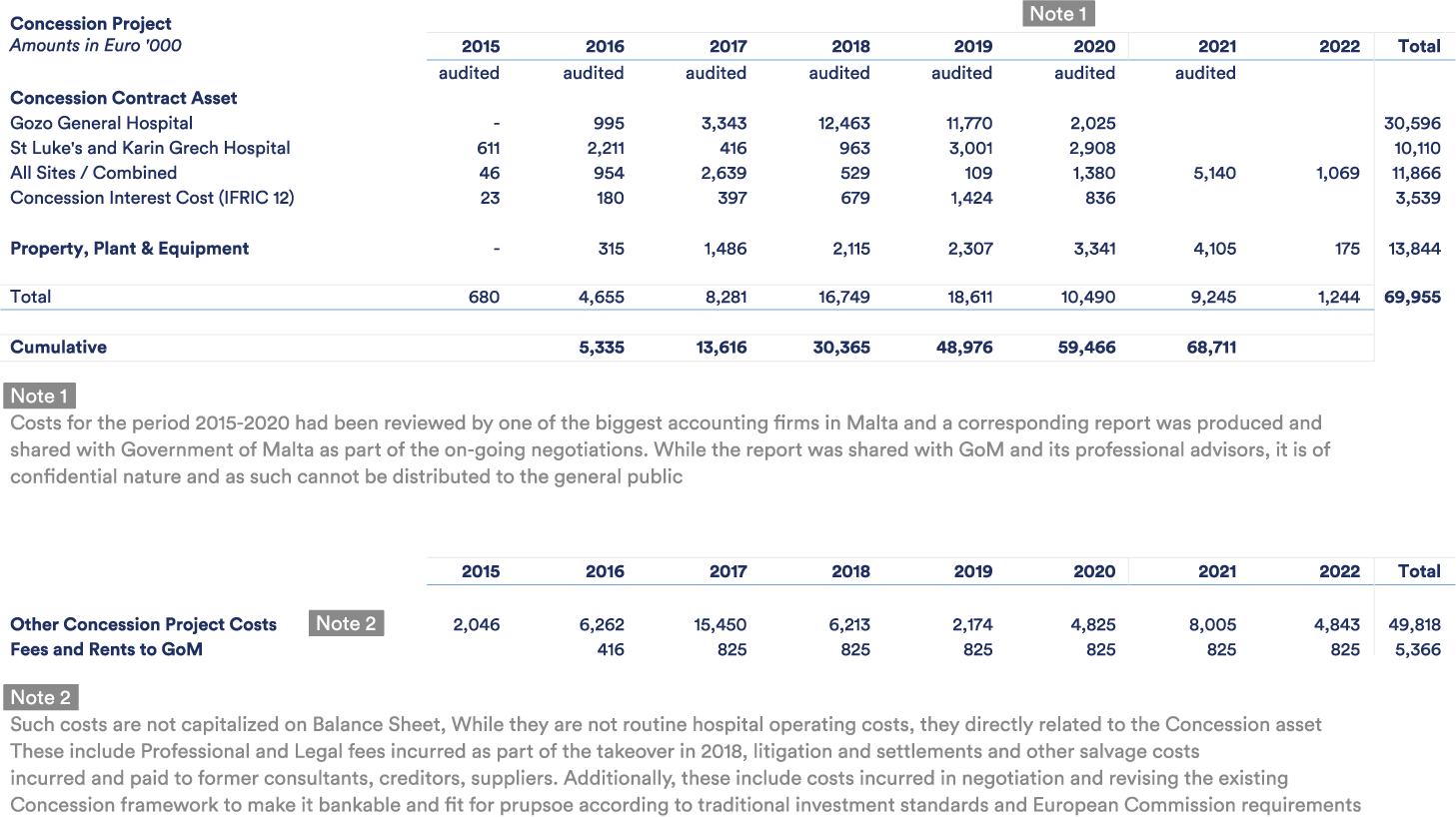

Total project capital investment over concession lifetime

Investing in improvements in facilities has been done despite the concession being underfunded operationally and despite the very high initial deficits and historical legacy costs. A major condition for the concession to be able to underwrite the envisioned investment is “bankability” – i.e. being able to demonstrate to financial sponsors that the concession is financial stable and economically feasible.